When Bitcoin was introduced in 2008, few could have predicted its impact on global finance. What began as an experimental digital currency has grown into a financial and technological force influencing markets, governments, and innovation worldwide. Today, Bitcoin is widely recognized not only as the pioneer of cryptocurrency but also as a catalyst for blockchain development and decentralized finance. Understanding its history offers insights into how digital assets evolved, where they stand today, and the trends shaping their future in 2025.

The Birth of Bitcoin: Satoshi Nakamoto’s Whitepaper

In October 2008, a person or group using the pseudonym Satoshi Nakamoto published the whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System.” The paper proposed a decentralized system allowing digital transactions without intermediaries like banks. The breakthrough was solving the double-spending problem, ensuring that digital money could not be copied or spent twice.

By January 2009, the Genesis Block was mined, officially launching the Bitcoin network. Embedded within it was a message referencing the global financial crisis, signaling Bitcoin’s role as an alternative to traditional systems.

Early Milestones in Bitcoin’s Development

Bitcoin’s early years were marked by experimentation and a small but dedicated community of cryptography enthusiasts.

Key Moments

- First Bitcoin Transaction (2009): Satoshi sent 10 BTC to Hal Finney, a well-known developer.

- Bitcoin Pizza Day (2010): Laszlo Hanyecz paid 10,000 BTC for two pizzas, marking the first real-world use of Bitcoin.

- Early Marketplaces: Informal exchanges began trading Bitcoin for fiat, laying the foundation for modern crypto markets.

These milestones established Bitcoin USDT as a functional digital currency, even though mainstream awareness remained minimal.

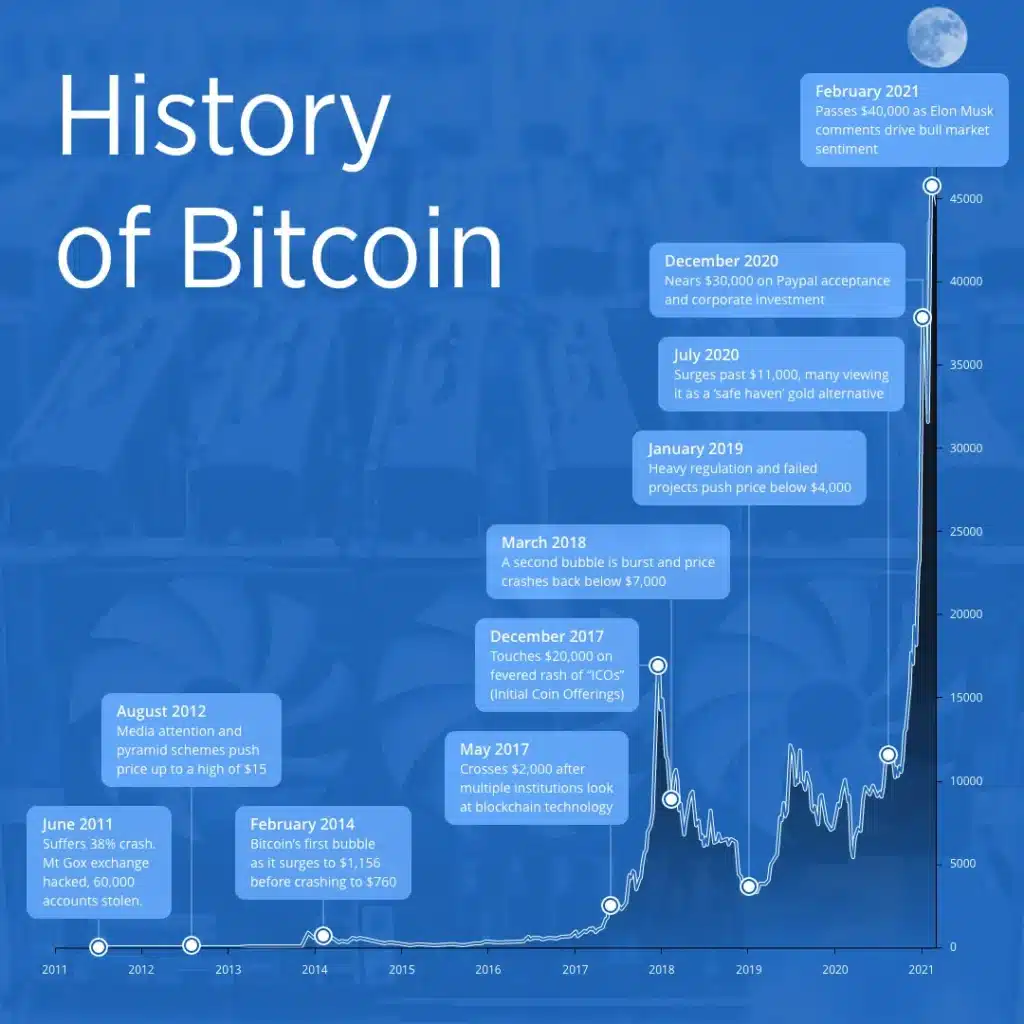

Challenges and Setbacks in Bitcoin’s Journey

Bitcoin’s rise was not without controversy and obstacles. XRPUSDT and other early altcoins also faced scrutiny as governments and regulators worked to understand the implications of digital currencies.

Silk Road and Government Scrutiny

The association with Silk Road, an online marketplace that accepted Bitcoin, brought global attention and regulatory pressure. While it highlighted Bitcoin’s utility, it also fueled skepticism about its legitimacy.

Mt. Gox Collapse

In 2014, Mt. Gox, the largest Bitcoin exchange at the time, collapsed after losing around 850,000 BTC. This incident underscored vulnerabilities in early crypto infrastructure and shook public trust.

Volatility

Bitcoin’s price experienced dramatic swings, rising from cents to hundreds, then falling back sharply. Critics dismissed it as speculative, while supporters viewed volatility as part of an emerging asset class.

The Rise of Bitcoin as “Digital Gold”

By the mid-2010s, Bitcoin’s narrative shifted from a niche payment tool to a store of value comparable to gold.

2017 Bull Run

In 2017, Bitcoin surged past $20,000, capturing mainstream media attention. The surge was driven by global demand, the rise of initial coin offerings (ICOs), and expanding retail adoption.

Institutional Adoption

From 2020 onward, large corporations and funds began integrating Bitcoin:

- Tesla announced Bitcoin purchases.

- MicroStrategy made it a treasury reserve asset.

- Traditional financial firms launched Bitcoin-related products.

By 2025, Bitcoin is recognized in global markets as a hedge against inflation and economic instability, often called “digital gold.”

Bitcoin’s Impact on the Crypto Ecosystem

Bitcoin’s success inspired thousands of other cryptocurrencies and new blockchain applications.

- Altcoins: Projects like Ethereum expanded blockchain use cases into smart contracts and decentralized apps.

- Blockchain Adoption: Industries including supply chain, healthcare, and gaming explored blockchain solutions.

- DeFi and NFTs: Bitcoin’s foundation paved the way for decentralized finance and digital ownership economies.

As of 2025, Bitcoin remains the benchmark for crypto markets, influencing investor confidence and adoption trends.

Where Bitcoin Stands in 2025

Bitcoin’s role continues to evolve with broader acceptance and regulatory clarity.

Market Status

- Market capitalization remains the largest in the crypto sector.

- Daily trading volumes exceed billions, with significant participation in both developed and emerging markets.

Regulatory Landscape

Governments worldwide are working on crypto-specific frameworks, balancing innovation with consumer protection. Regulatory clarity has improved institutional trust.

Global Trends

- Adoption in Emerging Markets: Countries in Africa, Latin America, and Asia are embracing Bitcoin for remittances and financial inclusion.

- Integration with Finance: Payment providers and fintech companies are expanding Bitcoin’s accessibility.

Bitcoin has transformed from an experiment into a pillar of the digital economy.

Conclusion: Bitcoin’s Legacy in Global Finance

From Nakamoto’s whitepaper to global recognition, Bitcoin has redefined how people view money and technology. Its journey reflects resilience, innovation, and the power of decentralized systems. While volatility and risks remain, Bitcoin’s legacy as the world’s first cryptocurrency is undeniable. It stands as a symbol of financial independence, technological advancement, and the potential for global inclusion.

FAQ Section

What year was Bitcoin created?

Bitcoin was launched in January 2009 with the mining of the Genesis Block by Satoshi Nakamoto.

Who is Satoshi Nakamoto?

Satoshi Nakamoto is the pseudonymous creator of Bitcoin. Their true identity remains unknown.

Why is Bitcoin called “digital gold”?

Bitcoin is compared to gold because it has a capped supply of 21 million coins, making it scarce and often used as a store of value.

Is Bitcoin legal in 2025?

Yes, Bitcoin is legal in most countries, though regulatory frameworks vary. Some governments have introduced specific laws for crypto trading and taxation.

Is investing in Bitcoin risky?

Yes, Bitcoin carries significant risk due to price volatility and regulatory changes. This article does not provide investment advice. Always conduct thorough research before participating in cryptocurrency markets.

Want to explore beyond Bitcoin? Sign up on MEXC to access over 3,000 cryptocurrencies, advanced trading tools, and competitive fees. Start your crypto journey today with one of the world’s fastest-growing exchanges.

- 3shares

- Facebook0

- Pinterest0

- Twitter3

- Reddit0