Amid rising electricity prices in many parts of the United States – monthly residential rates have increased 14% in the last year – more and more homeowners are looking to solar energy for home their energy needs. And although the up-front benefits of having a solar installation typically revolve around lowering your monthly bills, there’s an earth-shattering profit center that goes overlooked. Here’s where Virtual Power Plants (VPP) come in, a ground-breaking technology that turns millions of solar systems into money-making power stations.

Solar homeowners now have the ability to create a high return investment by connecting with a VPP, selling excess power during high demand, and stacking financial benefits. Unfortunately, however, the fact remains that many investors find it difficult to maximize ROI on their solar investment and the problem stems mostly from the complexity of participation models and routing profits. So stay tuned, because this guide is going to show you how you can turn your home solar system from a bit of a money saver into a money-earning machine, with some participants in VPPs earning up to $1-3,000 in extra profit per year on top of regular savings.

Understanding Virtual Power Plants: Your Profit Engine

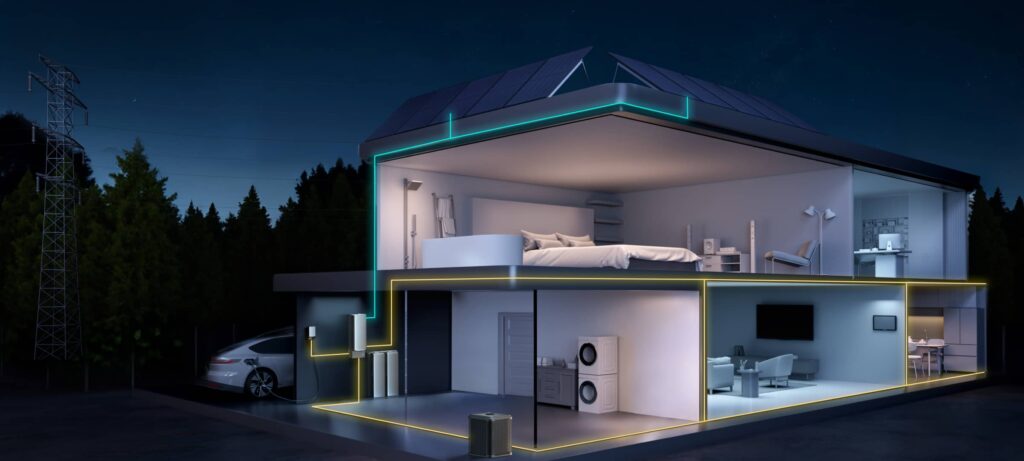

Virtual Power Plants are a game-changer in energy management, serving as intelligent systems that harness and optimize distributed energy resources (DERs) from disparate locations. Unlike conventional power plants, VPPs create a collaborative virtual solar community; thousands of solar-powered homes working together to help stabilize the electrical grid when it needs it the most. This collective endeavor allows homeowners to cash in on their surplus till to date unrewarded energy generation.

At the heart of VPPs is the use of aggregated DERs. Whereas traditional grid participation just injects spare energy back into the system at set rates, VPPs use sophisticated software to determine not only when, but how much each participant will contribute. This smart coordination also enables the network to act quickly to grid requests and in turn extract value by deploying energy strategically.

For investors, VPPs present a new level of scalability benefits. As the network expands, it’s opportunistically able to get better pricing and potentially secure more profitable grid services contracts. The latter gives every member access to premium rates for their work at peak times. Beyond that, VPP technology offers hands-free participation, allowing homeowners to earn money without having to oversee energy production.

Step-by-Step Guide to Joining a Virtual Power Plant

Prerequisites for VPP Participation

You must meet certain technical criteria to join the Virtual Power Plant network. Key components are a smart inverter with remote control and a sophisticated monitoring system to facilitate communication in real time with the VPP network. Most VPP offers will require at least 5kW of solar installed at your property but in reality, ideal profitability will often be achieved with 7.5kW or higher (dependent on your household’s electricity consumption profile).

Enrollment Process Demystified

Start by finding VPP programs in your region with your utility company or a third-party aggregator. Comparison shop for compensation structures to determine whether an offer is fixed at a certain rate per kilowatt-hour produced, or at market-based rates tied to broader demand. Minimum participation, payment terms, and exit clauses should be principal contract concerns. This integration typically includes a remote system review, software installation and connection protocol setup, and is usually finalized within 1-2 working days.

Optimizing Your Participation

Make the most of your VPP savings. To get the best value from your VPP, you should shift your energy use to the time of day when the VPP is producing the most energy. Move large appliances such as washing machines to operate in off-peak times and use your VPP dashboard to monitor performance. Track your input power, income, and the efficiency of the system using the interface. Most who are successful with eBay integrate their home energy management system with automation so that the load shape fits what the grid is asking, making it a “set and forget” thing, as opposed to requiring human intervention every day.

Financial Incentives for Solar Installation

It has never been more financially rewarding to invest in solar, and there are layers upon layers of special incentives which means there is a lot of cost savings to be had. At the federal level, the ITC now provides a whopping 30% tax credit on the amount of your system, both parts and labor. This credit is a direct credit that lowers your federal tax burden dollar for dollar, which means reducing the bite by almost a third out of the gate.

State incentives are wildly different, but often add a good amount on top. Many states have Solar Renewable Energy Certificate (SREC) markets, in which homeowners can sell certificates for each megawatt-hour of solar energy they produce, regardless of use or feeding it back to the grid. SREC prices today vary between $10 and $400 per certificate based on where you live and market conditions. VPP enrollees may have preferential access to such programs with some utilities even offering enhanced SREC rates for VPP members.

Local utilities often offer extra incentives especially for VPP participants, such as performance-based incentives, smart inverter rebates, and special payments for participating in peak demand response. By depreciating – using a typical 5-year Modified Accelerated Cost Recovery System (MACRS) schedule – the system’s value from their taxes, also eligible to commercial investors, implementers can improve their return on investment timeline.

Strategies for Selling Excess Energy Profitably

Net Metering vs VPP Compensation Models

Conventional net metering schemes provide a fixed price for any surplus energy well below the retail rate of electricity. On the other hand, VPP compensation models offer value-added pricing that can be 3 – 5x more expensive at peak load times. Program Explanation — In VPP, program participants are paid a premium price in return for their aggregated contribution(s) during grid stress events and are often given a bonus for faster response times. Homeowners are able to maximize revenues from their energy exports using this advanced price mechanism by strategically exporting energy at the right time.

Revenue Optimization Techniques

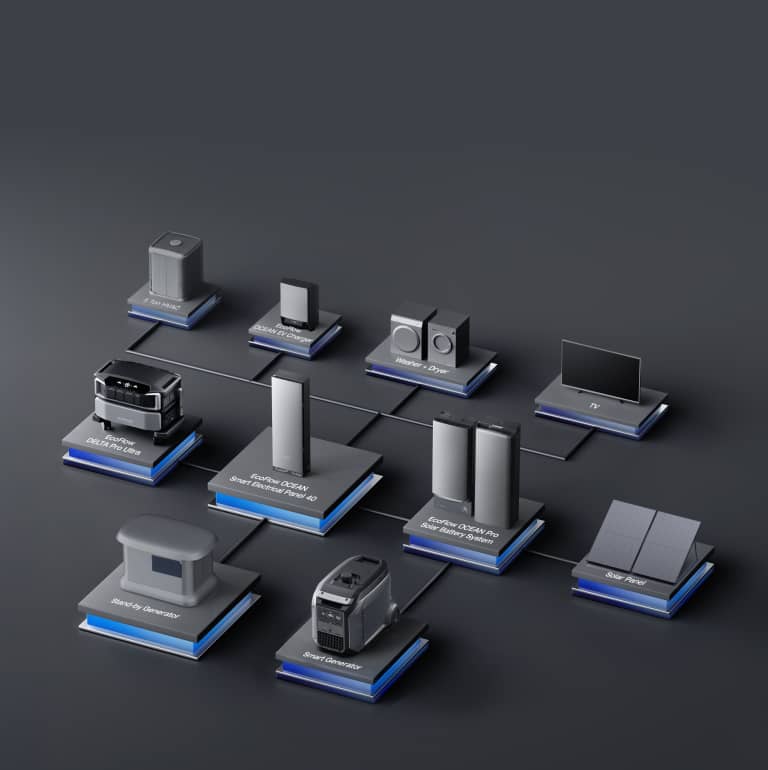

Adding batteries means arbitrage. Electricity generated by solar panels can be stored during time periods with lower prices and released for use when it becomes more expensive. As a response, leading manufacturers, such as EcoFlow, are providing intelligent battery solutions capable of performing these transactions when the market is favorable. Profitability is improved by weather-based production forecasting tools that predict the best times to store and release energy. Sophisticated VPP platforms monitor weather forecasts, past grid use demands, and market prices to advise on when the participant should be transferring energy (some report around 40% more yield than simple net metering implementations).

Designing Scalable Solar Solutions for Growth

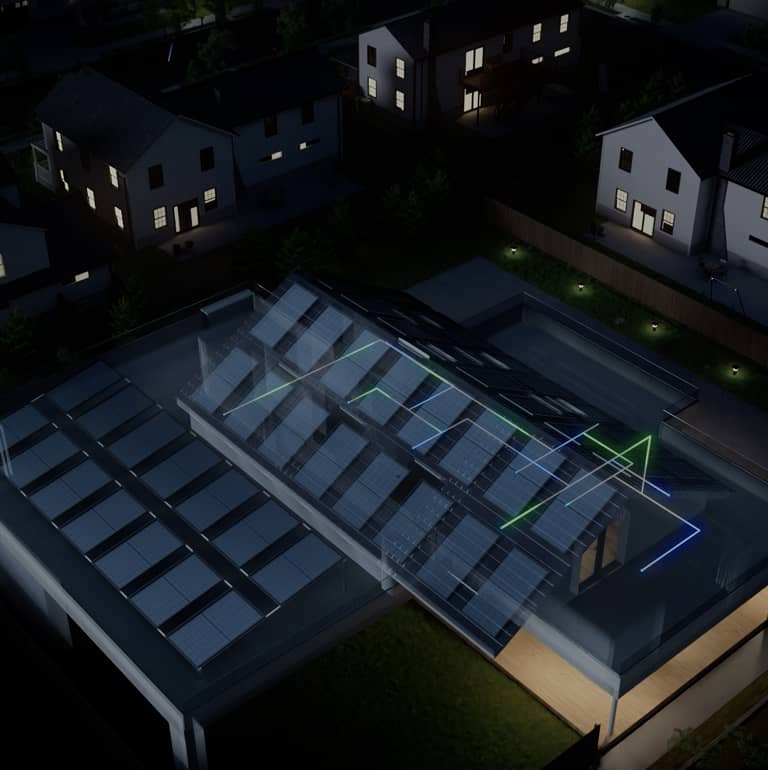

A well-designed solar system structure allows for further strategic scaling as your energy requirements and profit prospects increase. Begin with oversized conduit runs, oversize your inverter for additional panel capacity in the future without expensive retrofits, and ensure flexibility for rapid, easy, hassle-free additions or an entire system. In planning your first installation, make sure to leave the roof or ground area empty where it receives the best direct sun for future expansion phases, so new panels can be added to your system and be seamlessly integrated into your array.

Integrating battery storage needs sustained attention to both current and future requirements. Start with a battery-ready inverter system, even if you aren’t putting in storage right away. Make provisions for future battery integration with your panel upgrades, such as dedicated critical load panels and transfers. Modern systems support modular batteries so you can start small and gradually expand to your budget or energy arbitrage needs.

Make sure that your solar portfolio includes commercial and residential installs to get the best incentives and mitigate risk. Commercial systems are usually eligible for extra tax benefits and accelerated depreciation, while residential ones generally provide more VPP participation choices. “I want to safeguard my investment for the future.” Install EV-ready charging infrastructure upon initial system build. Add appropriately sized electrical service upgrades and pre-wiring for Level 2 charging stations to ensure that your property increases in value with the proliferation of electric vehicle adoption.

Maximizing Solar Investment Through VPP Integration

The synthesis of Virtual Power Plants, strategic energy sales, and broad incentive programs has produced an unprecedented opportunity for homeowners to turn their solar investment into a lucrative energy venture. Utilizing VPP networks, participants can maximize profits with complex energy trading, high compensation rates, and automated optimization algorithms. The secret to continued profitability is the installation of scalable system designs that can cope with changes to requirements and advancements in technology.

As more and more customers and regulators value distributed energy resources, early VPP adopting entities will capitalize on increasingly lenient incentive structures and market openings. The seismic shift from old-world net metering to real-time VPP participation is not just a technology upgrade, but a game-changing transformation in how value is created in the residential solar value chain. The future is now. The time to start unlocking the full potential of your solar investment with a comprehensive financial analysis, and VPP enrollment in your region, is now. The energy future is distributed, intelligent, and profitable – get ahead by being the first to own it.

- 0shares

- Facebook0

- Pinterest0

- Twitter0

- Reddit0