Introduction

In today’s fast-moving stock market, stock analysis and evaluation can quickly turn into outdated information. And with the right tools, you can accomplish more, work smarter and access possibilities you never even knew existed. Sometimes staying ahead means you’re going to have state of the art, reliable solutions that suit your individual needs.

In this in-depth article, we dive into the 9 best stock analysis tools and services for traders and investors. We will supply in-depth analysis of each option’s features, pros and cons. Regardless of whether you’re a beginner wanting to learn or an experienced trader looking to sharpen your tool set, this guide will5 empower you so that you are able to find the solutions that work best for you and your investing goals.

Website List

1. BestStock AI

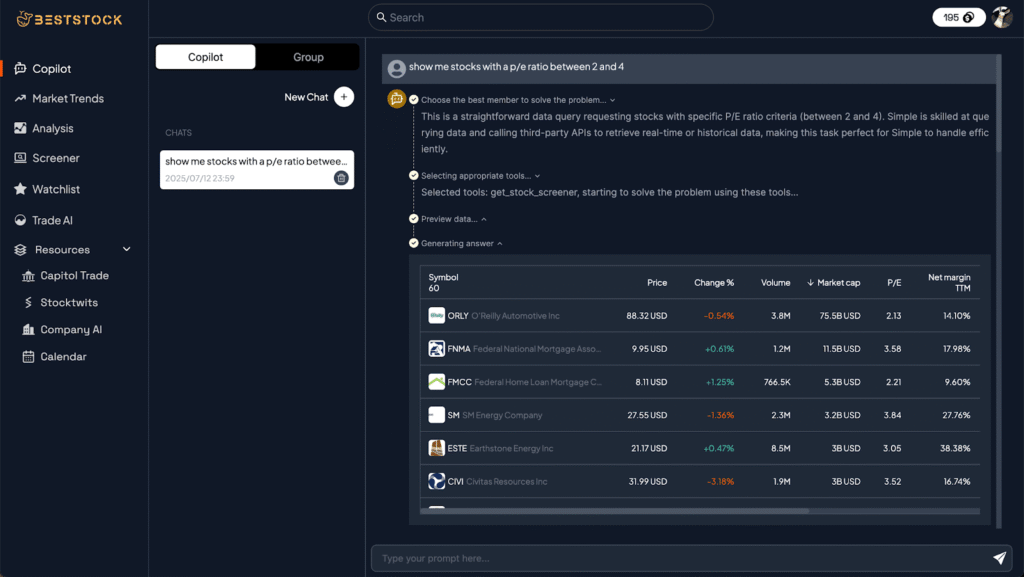

What is BestStock AI

BestStock is a AI-powered stock analysis platform that makes financial data analysis easy for investment teams. It simplifies consumption and calculating of financial data into actionable insights for on-the-fly decision making, resulting in auto-generated reports for quick and business-ready decision/s. BestStock afford investors ability to maximise their strategy and bring an improvement in their return on investment supported by comprehensive market intelligence and tailored analysis. And with our integrated Capital Gains Tax Calculator, you could also estimate the tax on the net gain and sweeten your after-tax returns.

Features

- Machine Learning for finance that does the data entry and processing for you, so that insights are immediately actionable

- Up to date corporate financial intelligence including US stock financials and earnings transcripts

- Daily AI insights to aid investment decisions

- Advanced statistical and business analysis metrics to consider for detailed financial analysis.

- Market intelligence elements that merge seamlessly for more intelligent decision making

Pros and Cons

Pros:

- AI-driven analytics automates data processing for faster time to insights

- Detailed US stock financials and earnings call transcripts

- Organizer makes learning, researching and studying easy!

Cons:

- It is more expensive than a number of other financial analysis software.

- The app has some offline capabilities to allow data retrieval and processing without a connection.

- Being capable of learning full feature set might require more human time and recourse.

2. StockAnalysis

What is StockAnalysis

StockAnalysis is an advanced stock investment tool that includes access to detailed information about 100,000 of stocks and funds, including all companies in the S&P 500 index for free. Its main task is to bring precise stock quote, news, financials just like company data, competitor information to your hands enabling you make wise investment decisions. Between offering stock screening and market movers, StockAnalysis is a resource designed for basic to advanced investors who want to shortcut their regular analysis.

Features

- Huge database with accurate information covering over 100k stocks and funds including all the latest stock related news for S&P 500 companies

- Advanced stock analysis for stocks with real-time price quotes, news updates, trendlines, and breakouts points.

- User friendly Stock Screener for stock discovery based on your own custom criteria, e.g. filter by market movers based on volume or gainers and losers in specific stock exchange markets suited to your investment strategy

- In-depth market analysis to make informed trading decisions with top gainers and losers

- Personalized watchlist for smooth access to all of your favorite stocks and an ease-of-mind in keeping track of their performance

Pros and Cons

Pros:

- Full access to reliable information on multiple securities – enither stocks not funds (all SP500 companies)

- A full suite of stock trading tools including charts, forecasts and financials

- Major stock market movers updated in real-time so you will make better decisions

- User frieldly stock screener to discover stock new opportunities for you.

Cons:

- Risk of information overload with a large number of available data and features

- Limited help for beginners in how to properly use the advanced analysis tools

- Sometimes lag in real-time data refresh which may hinder the prompt decision making.

3. Morningstar

What is Morningstar

Morningstar is a top investment research company offering both individual and professional -depot.bundle plans on all kinds of investments from stocks to mutual funds to ETFs. A website dedicated to investors, the 7 Best Stocks site provides features, tools, and ratings that give you everything you need to take your investing game to the next level. Morningstar seeks to provide users with easy-to-follow tools to make smarter investment decisions, grow their wealth, and enrich their lives.

Features

- Real-time market data, including: Main Indices, Market Movers, Sector Indices and Economic Calendar

- According to Morningstar Style Box methodology, it places 70% and above of its assets in Large value.

- Insightful discussions and expert commentary on investment ideas and risks

- Get access to over 200+ investment options and resources to make informed choices

- In depth performance metrics and analytics so you can effectively track your investments

Pros and Cons

Pros:

- Thorough market analysis over a broad range of investment opportunities

- Access to expert thoughts and investment ideas from seasoned professionals

- Easy-to-use resources for assessing market performace and trends

- A range of investment algorithms, from value investing to growth strategies

Cons:

- Little or no concentration in niche or special commitment investing opportunities.

- Some material may require prerequisite knowledge of investment topics to fully comprehend

- The app can sometimes have a lag time during fast market conditions

4. WallStreetZen

What is WallStreetZen

WallStreetZen is a stock market research platform catered towards beginner and intermediate investors who are serious about learning to trade for themselves, and provides tools such as screeners and Zen Ratings that help weed out investment duds. After searching through 115 of these factors, the service will find you A-rated stocks with an average yearly return of 32.52% per year, thus helping you make smarter investments. With an intuitive user interface and advice from top analysts, investors can make informed market decisions.

Features

- Advanced Zen Ratings quant model uses 115 proven factors for analyzing the best picks

- High-growth stock selections, with an average return of 32.52% per year

- The points of best-rated analysts to create investment decisions on

- Progression of strong buy ratings and tracking the market to place informed trades on moving stocks

- Easy-to-use interface built to help investors research stocks and analyze their portfolios

Pros and Cons

Pros:

- Relies on a quant model that examines 115 known factors to select promising stocks

- Here are some other A-rated stocks showing favorable average annual returns: 32.52%

- A strong buy rating by leading analysts adds to our investment decision.

- Stock insights–Trendfollowing and trend trading, we provide data and insight into the market changes every day.

Cons:

- The high price can discourage some users that require affordable products

- Insight into how the mobile app functions is frustratingly limited for investors on the go

- Analyst ratings are not practical for all investment strategies or risk levels

5. MarketBeat

What is MarketBeat

MarketBeat is a full financial news organization dedicated to investors, research and the stock market. Its focus is on enabling its users with stock trends, stock performance and investment ideas from our large market of big data, you can make your trading decisions today by taking advantage of our analysis provided by AI and machine learning. Featuring articles, price targets, and market analysis from contributors at MarketBeat enables access to the insides of both the freshest new investor options as well as proven strategies.

Features

- In-depth analysis of tech stocks that are being driven by artificial intelligence technology, including profiling 4 AI-focused companies.

- Convenient stock success and trend updates timely enough to keep you in the loop

- Analysis from experts on market movements in energy and cyber security sectors

- Analysis and commentary on what drove the stock moves up or down. These include new product launches, competitors’ news, as well as analysts who covered said stocks moving forward/downgrades.

- The Stocks to Watch column is published every morning which includes coverage of early market action that affects stock rallies and potential backslides for values trade decisions

- Easy-to-use platform with live data for successful trading and portfolio management

Pros and Cons

Pros:

- Detailed analysis of promising undervalued tech stocks that help make investment decisions.

- Regular reports on stock market development and particular stocks performance.

- Diverse sectors description, such as AI and energy that provides more opportunities for investment.

- Availability of experts’ opinions and projections from professionals in the industry.

Cons:

- Threat of too much information to process due to frequent coverage.

- Weak promotion of lesser-known stocks that might prevent me from discovering some potential niche opportunities.

- High level of market knowledge required for some articles.

6. Zacks

What is Zacks

Zacks Investment Research is under common control with affiliated entities (including a broker-dealer and an investment adviser), which may engage in transactions involving the foregoing securities for the clients of such affiliates. And at its heart is actionable intelligence – including predicted earnings reports and stock ratings, which let you know whether a stock is set to shine or blow. With an emphasis on research-based methods, Zacks continually provides profitable investment highlights among the financial industry and assist users to achieve their investing goals.

Features

- Insider perspectives from experienced economists to help shape your investing

- In-depth examination of market trends and insights into the new products as well as developments across the industries.

- In-depth research reports that help you understand the why behind every trade.

- Comprehensive coverage Stay abreast of market opportunities with the latest news, analysis, and recommendations to guide your trading decisions.

- Strategic Insight for navigating complex market conditions

Pros and Cons

Pros:

- Possibility for higher stock market activity as investor confidence gets a lift from the rate cuts

- Positive effect on quarterly earnings for companies that gain from reduced borrowing costs

- Analysis from experienced strategists helpful for investors seeking direction

Cons:

- Doubts about the ability of rate cuts to drive durable market gains

- Uncertainty of potential market volatility are investors react to economic data and policy changes

- Differences in macroeconomic policies and performance of individual companies could be divergent

7. Seeking Alpha

What is Seeking Alpha

Seeking Alpha is a site that offers research, analysis and discussion on stock market news. Its primary mission is to promote investor intelligence by meticulously filtering information and providing around-the-clock, reliable news to help investors make more informed decisions in the market. With news alerts and analysis tools, Seeking Alpha seeks to make smarter investing more accessible to every investor.

Features

- Access to newswire let you learn breaking news and which stocks are hot to the touch.

- Expert analysis and powerful stock ratings to help you easily in vest like a pro

- Complete suite of tools for tracking stocks, commodities, futures and all major world indices

- Crowd-sourced updates that don’t make you lose your way in the markets latest trends

- Easy to use interface for all levels of current or prospective investors

Pros and Cons

Pros:

- Free access to full coverage of breaking stock news

- Detailed analysis and strong stock ratings from a scrappy team of analysts

- A complete set of tools for investors in a range of markets and asset classes

- Real-time reports of large stock purchases or sales affecting stocks mentioned in alert emails

Cons:

- Users may need to set up an account, which might discourage some voters

- Little ability to customize news feeds and alerts for the user

- Potential for information overload in the volume of news and analysis available

8. MarketWatch

What is MarketWatch

MarketWatch is a financial information website that provides business news, analysis, and stock market data. It is committed to an enterprising coverage of business, revealed through the magazine’s sharp analysis and strong opinions, as well as online and social media platforms that provide unlimited access to winning business ideas, markets data, company rankings, insights and influencers. With full-market coverage and in-house stories that inform, MarketWatch keeps you informed about economic trends and how to maximise your investments.

Features

- User-friendly design that increases user retention and reduces ramp-up time

- High degree of security to safeguard sensitive information and compliance

- Tailored workflows to align with your specific business processes

- Use real-time collaboration tools to develop team communication and productivity

- Robust analytical portal for performance tracking and strategic decision-making

Pros and Cons

Pros

- Offers integrated, real-time and historical market data by both fundamental information (material events) as well as technical data analysis.

- Clean and easy-to-use UI, allowing you to navigate with ease

- Consolidates all the news, analysis and market data in one place for easy research

Cons

- No advanced analytics compared to the likes of premium platforms like Bloomberg Terminal

- Requires payment for deeper insights and premium features

- May seem cluttered or overwhelming to new investors because of information overload

9. Simply Wall St

What is Simply Wall St

About Simply Wall St Simply Wall Street is a financial technology company, who’s focus is to take the frustration out of investing. Its mission is to make investing in stocks easy for the novice investor and at least easier for all investors who do not have time to pick individual stocks with a reliable national economy stock analysis system. Simply Wall St provides investors with the support they require to become better investors, by enabling them to upload their portfolios and compare their performance.

Features

- Easy to use interface for all types of commerce and stock screening and research.

- 7,000,000+ users enjoying the same experiences, talking to one another and getting the help they need.

- Tools that save time and bring efficiency to your investment process, improving decision making

- Well-behaved — because customer service should make users happy and provide support

- Logic tools such as the stock validator to enhance portfolio management and analysis

Pros and Cons

Pros:

- Intuitive app for investors of all skill levels

- Time-saving details that provide everything a traveler to India could need without research

- Ability to upload the portfolio performance and results accurately

- Offers comprehensive analysis of companies Increasing investment infront decisions

Cons:

- Could be a learning curve for people who are not familiar with stock trading

- Limited offline use for when you don’t have an internet connection

- May see a potential absence of advanced features when stacked against professional-grade instruments

Key Takeaways

- Research before selecting a stock analysis tool – they’re not all created equal.

- Question your unique investment methodologies and end goals when comparing stock analysis choices.

- Begin with free trials, where possible, to tinker with charting, screening, and other analytical features before you shell out.

- Read User Reviews and Testimonials When looking at user reviews to gauge effectiveness, you’ll get the benefit of real-world testing.

- Keep abreast of latest developments in stock analysis and adapt new technologies.

- Consider the value of customer service and educational resources, particularly for new investors.

- Ask yourself how well the stock analysis will scale, and how easy it is to fit in with your existing investment strategies.

Conclusion

What we hope to have brought you in this list is an understanding of what the market has to offer, whether you’re a beginner or an experienced professional. The harsh truth is that there isn’t a one-size-fits-all investing platform, but success will ultimately be determined by how well your trading app meets your individual needs and offers the best combination of analysis, ease of use and value for money to suit your investment style.

Whether you’re a novice wanting to know how to invest or an experienced trader trying to shave a few dollars off your next trading fee, the choices above provide current best of breed across the board. Every platform has something to offer: it might be strong data analytics or analytics in real time, user-friendly design and experience or great customer support.

We suggest using this guide as a starting point for research, however, ultimately you are the only one who can figure out which of these tools will work best for you. Stock analysis for the future looks quite good and if you pick a proper solution today, your investing journey will be much better in years ahead. Today, get into the world of stock analysis and empower yourself with information!

- 3shares

- Facebook0

- Pinterest0

- Twitter3

- Reddit0